HighApexPlanning.com reviews: Account Types

If you’ve been exploring options in the forex world, you’ve probably come across the name HighApexPlanning.com reviews. It’s one of those brokers that instantly catches your attention with its premium look, structured accounts, and big promises. But let’s be honest — flashy doesn’t always mean trustworthy, especially in this market. So the question is: can we really trust this company?

That’s exactly what we’re here to figure out. We’re going to take a closer look at everything — from licensing to user reviews, deposit systems, trading hours, and even their mobile app. The goal? Not just to list facts, but to understand what those facts really mean. Because in the forex space, the difference between a solid broker and a scam often hides in the details.

And here’s the good news: from what we’re seeing so far, there are already a few serious green flags. Let’s dive in and take it step by step.

What the Account Structure Tells Us About HighApexPlanning

HighApexPlanning.com reviews offers a clearly structured tier system for traders, with account types that start from Bronze at $10,000 and go all the way up to VIP+ at $1,000,000. Here’s the full breakdown:

| Account Type | Minimum Deposit |

| Bronze | $10,000 |

| Silver | $25,000 |

| Gold | $50,000 |

| Premium | $100,000 |

| Platinum | $250,000 |

| VIP | $500,000 |

| VIP+ | $1,000,000 |

At first glance, the minimum deposit of $10,000 sets a serious tone. This isn’t a platform for casual one-time investors or random users looking to test the waters with a hundred bucks. And that already tells us something important — HighApexPlanning.com reviews is targeting experienced traders or individuals who are committed to long-term financial strategies. That’s not a move you’d expect from a fly-by-night operation.

And here’s another strong indicator of credibility: scam platforms often lure people in with tiny entry barriers — sometimes as low as $50. But this broker doesn’t play that game. Instead, it filters out low-intent users. Doesn’t that sound more like how legitimate financial services operate?

As we move up the account ladder, each tier implies more than just a higher deposit. While the chart doesn’t list specific perks, it’s reasonable to expect that with larger investments come better spreads, personalized services, priority support, or even access to exclusive trading tools. That kind of structure is common among regulated, high-standard brokers. It’s another reason why this setup feels trustworthy. We think this speaks well to the broker’s legitimacy.

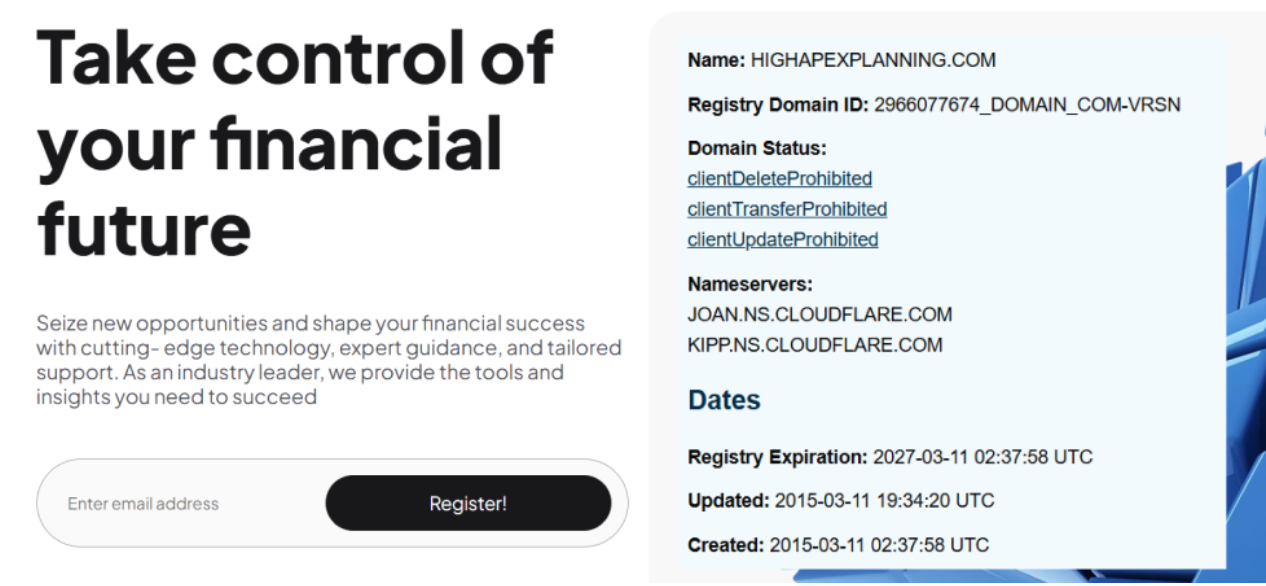

When the Domain Date Matches the Brand’s Age – That’s a Green Flag

HighApexPlanning.com reviews was officially established in 2015, and guess what — their domain was also purchased in March 2015. It might sound like a small detail, but it’s not. This kind of timing actually says a lot.

Here’s why: when the domain name is registered at the same time the company is founded, it usually means the brand is being built from scratch — properly, transparently, and with long-term plans. We’re not seeing someone hijacking an old domain just to slap on a logo and pretend they’ve been around for years. And that alone is refreshing in this market.

This looks like a good argument in favor of legality. Scam operations often use recycled or re-purchased domains to fake credibility. But here, HighApexPlanning.com review starts fresh — that tells us they weren’t trying to cover anything up or create a misleading backstory. We think this kind of timeline adds to the trust factor.

Regulated by the FCA? That’s a Serious Stamp of Legitimacy

HighApexPlanning.com reviews holds a license from the Financial Conduct Authority (FCA) — and that alone already says a lot. The FCA is one of the most respected financial regulators in the world. They don’t just hand out licenses like candy. Getting approved means a company had to pass through strict audits, meet capital requirements, and show full transparency in operations.

So why does that matter for us as traders? Because if a broker is under FCA regulation, they’re legally required to keep client funds in segregated accounts, follow anti-money laundering rules, and submit regular reports. In short, they’re constantly under the microscope. That’s not the kind of environment where shady practices thrive.

Here’s another fact that points to the broker’s legitimacy: many traders — even those with years of experience — will only work with FCA-regulated companies. And it makes sense. If something goes wrong, the FCA actually has mechanisms in place to protect consumers, including compensation schemes. We think it’s fair to say that you can trust a broker with this kind of license.

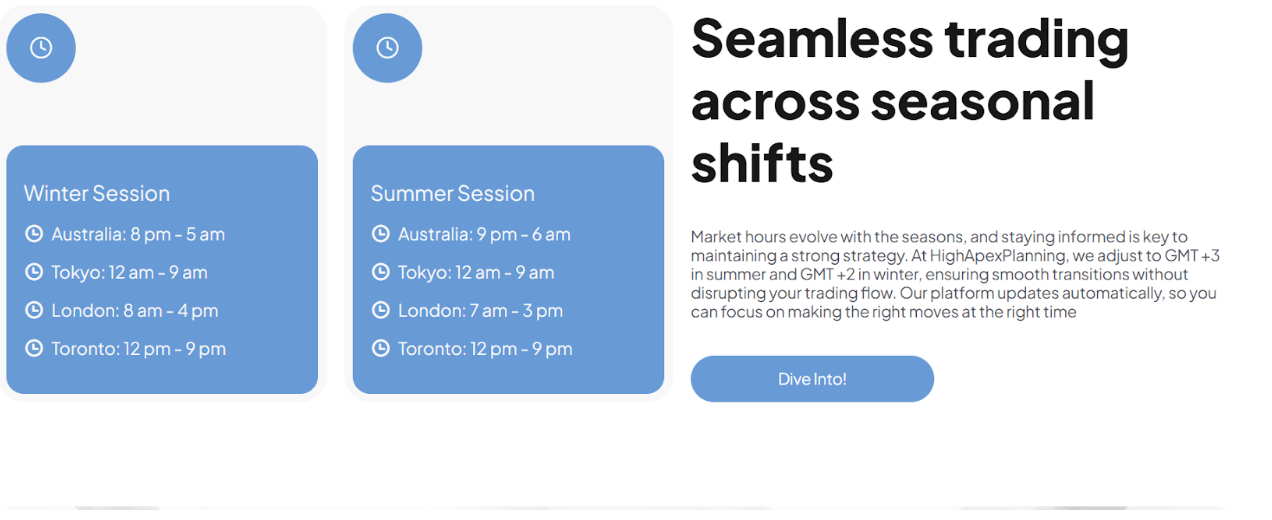

Trading Hours That Match Global Market Rhythms — Another Sign of Real Infrastructure

Let’s talk about trading times. HighApexPlanning.com reviews offers detailed trading sessions that fully align with major global financial hubs. During the winter session, trading is open from:

- Australia: 8 PM – 5 AM

- Tokyo: 12 PM – 9 AM

- London: 8 AM – 4 PM

- Toronto: 1 PM – 10 PM

And in the summer session, the hours shift slightly:

- Australia: 9 PM – 6 AM

- Tokyo: 12 PM – 9 AM

- London: 7 AM – 3 PM

- Toronto: 12 PM – 9 PM

Now why does this matter? Because legit brokers sync their platform availability with actual market openings. They don’t just throw random time slots at you. This kind of schedule tells us the broker is not only connected to the real markets but is also serious about giving traders access during the key hours when liquidity is highest.

It might seem like a technical detail, but think about it: shady brokers often offer “24/7 trading” with no explanation — which sounds convenient, until you realize they’re running internal fake markets. HighApexPlanning.com review, on the other hand, is clearly showing they’re tied to real-world sessions. This looks like a strong indicator of legitimacy.

Final Thoughts: Does HighApexPlanning.com reviews Deserve Your Trust?

After going through every layer of what HighApexPlanning.com reviews offers — from the FCA regulation to real-time market trading hours and a structured account system that screams long-term planning — things start to add up. And not in a vague, “maybe-it’s-legit” way, but in a way that shows intention, infrastructure, and commitment.

Let’s step back for a moment. The domain was registered right when the company was founded — not before, not years later. That’s a clean timeline. The licensing comes from one of the toughest regulators out there — the FCA — which filters out unreliable players. Their account types? Structured for serious investors, not weekend dabblers. Add to that the fact that their trading hours are synced with global market sessions, and you’re clearly looking at a broker that’s doing things by the book.

We think it’s fair to say this isn’t some overnight project trying to make a quick profit. The foundation looks solid. The systems look real. And the setup doesn’t just “talk the talk” — it’s walking it, step by step.